LED Display Market Research Report: The global LED display market is booming, driven by advancements in technology and rising demand across advertising, sports, and retail. According to recent research, the industry is set for significant growth, with innovations like mini-LED and micro-LED leading the way.

In this post, we’ll explore the key players, market trends, and future opportunities shaping this dynamic industry. Let’s dive in!

1. Types of LED Display

LED displays come in various types and can be classified in different ways:

1.1 By Pixel Pitch

(1) Small Pixel Pitch LED Displays (P2.5 and below)

Known for high definition, high refresh rates, and low power consumption in high-end indoor environments like meeting rooms, command centers, and exhibitions.

(2) Standard LED Displays (P2.5-P10)

Offering good cost performance, used for outdoor advertising, stage backgrounds, and sports arenas.

(3) Large Pixel Pitch LED Displays (P10 and above)

Primarily for outdoor viewing from a distance, ideal for locations like plazas, stations, and airports.

![]()

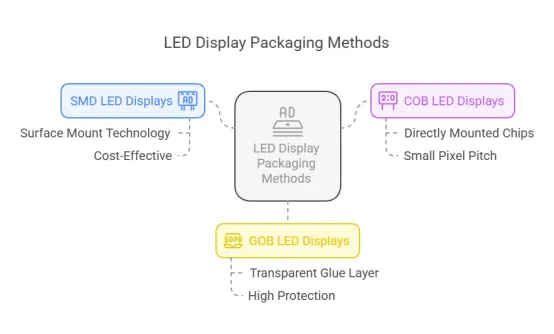

1.2 By Packaging Method

(1) SMD LED Displays

Using Surface Mount Technology (SMT), these are highly reliable and cost-effective, making them the most popular choice for various applications.

(2) COB LED Displays

Chips directly mounted on the PCB, provide high density, reliability, and protection, commonly used in small pixel pitch displays.

(3) GOB LED Displays

With a layer of transparent glue covering the surface, they are durable and widely used for outdoor displays due to their high protection.

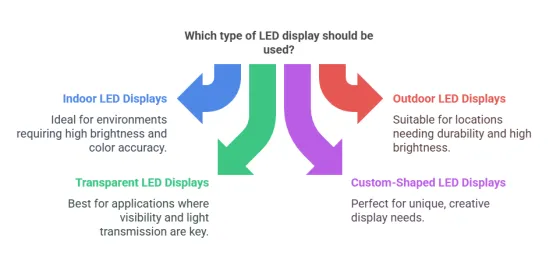

1.3 By Application

(1) Indoor LED Displays

Designed for indoor environments like conference rooms, report halls, and malls, they require high brightness, color accuracy, and clarity.

(2) Outdoor LED Displays

Built for outdoor conditions, they are used in plazas, stations, airports, and stadiums, needing high brightness, protection, and durability.

(3) Transparent LED Displays

These have high transparency, ideal for store windows and glass walls without obstructing natural light.

(4) Custom-Shaped LED Displays

Tailored for specific needs such as curved, spherical, or cube shapes, mostly for creative displays.

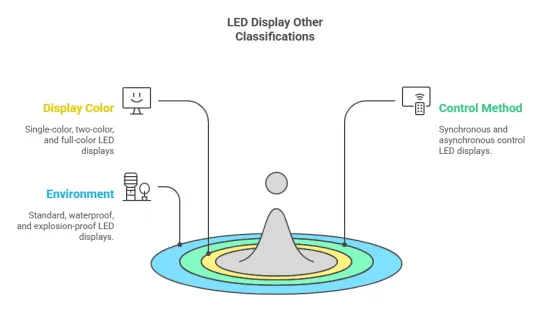

1.4 Other Classifications

By Display Color: Single-color, two-color, and full-color LED displays.

By Control Method: Synchronous and asynchronous control LED displays.

By Environment: Standard, waterproof, and explosion-proof LED displays.

2. LED Display Market Overview

The LED display market is growing fast, thanks to new tech and more ways to use it. From flashy ads in Times Square to jaw-dropping screens in sports stadiums, LED displays are changing how we see and experience the world around us.

2.1 Market Size and Growth Rate

(1) Global Market Size and Growth Rate

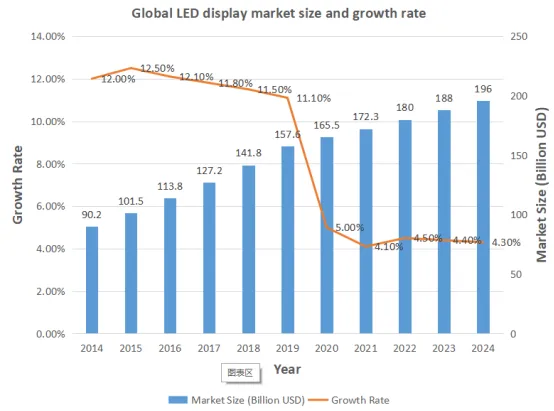

The global LED display market has maintained steady growth over the past decade, mainly benefiting from technological advances, expansion of application scenarios, and increased digital demand.

| Year | Market Size (Billion USD) | Growth Rate | Data Source |

| 2014 | 90.2 | 12.00% | Grand View Research |

| 2015 | 101.5 | 12.50% | Grand View Research |

| 2016 | 113.8 | 12.10% | Grand View Research |

| 2017 | 127.2 | 11.80% | Grand View Research |

| 2018 | 141.8 | 11.50% | Grand View Research |

| 2019 | 157.6 | 11.10% | Grand View Research |

| 2020 | 165.5 | 5.00% | Statista |

| 2021 | 172.3 | 4.10% | Statista |

| 2022 | 180 | 4.50% | Statista |

| 2023 | 188 | 4.40% | Frost & Sullivan |

| 2024 | 196 | 4.30% | Frost & Sullivan |

The global LED display market has maintained steady growth over the past 10 years, with an average annual growth rate of more than 10%.

In 2020, affected by the COVID-19 pandemic, the market growth slowed to 5.0%, but with the economic recovery after the pandemic, the market gradually resumed growth in 2021 and 2022.

References:

(1) Grand View Research. (2023). LED Display Market Size, Share & Trends Analysis Report By Product (Indoor, Outdoor), By Application (Advertising, Sports, Entertainment), By Region, And Segment Forecasts, 2023 – 2030.

(2) Statista. (2023). Size of the global LED display market from 2018 to 2028.

(3) Frost & Sullivan. (2023). Global LED Display Market Outlook.

(2) China Market Size and Growth Rate

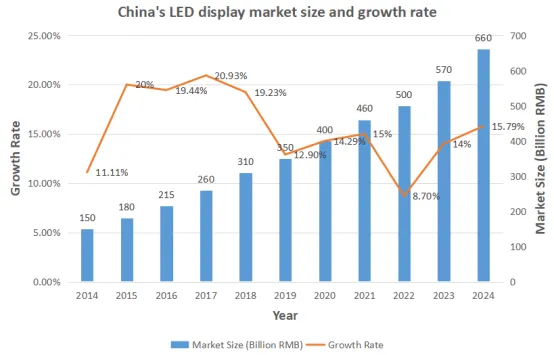

China is the world’s largest LED display market, benefiting from policy support, technological advances, and a huge domestic demand market.

| Year | Market Size (Billion RMB) | Growth Rate | Data Source |

| 2014 | 150 | 11.11% | China Optics and Optoelectronics Industry Association LED Display Application Branch |

| 2015 | 180 | 20% | China Optics and Optoelectronics Industry Association LED Display Application Branch |

| 2016 | 215 | 19.44% | China Optics and Optoelectronics Industry Association LED Display Application Branch |

| 2017 | 260 | 20.93% | China Optics and Optoelectronics Industry Association LED Display Application Branch |

| 2018 | 310 | 19.23% | China Optics and Optoelectronics Industry Association LED Display Application Branch |

| 2019 | 350 | 12.90% | China Optics and Optoelectronics Industry Association LED Display Application Branch |

| 2020 | 400 | 14.29% | GGII LED Research Institute |

| 2021 | 460 | 15% | GGII LED Research Institute |

| 2022 | 500 | 8.70% | GGII LED Research Institute |

| 2023 | 570 | 14% | GGII LED Research Institute |

| 2024 | 660 | 15.79% | GGII LED Research Institute |

The scale of China’s LED display market has maintained rapid growth in the past 10 years, with an average annual growth rate of more than 20%.

In 2020, affected by the COVID-19 pandemic, the market growth slowed to 7.2%, but with the economic recovery after the pandemic, the market gradually resumed growth in 2021 and 2022.

References:

LED Display Application Branch of China Optics and Optoelectronics Industry Association. (2023). 2022 China LED Display Application Industry Development Report.

GGII. (2023). 2022 China LED Display Market Research Report.

2.2 Market Driving Factors

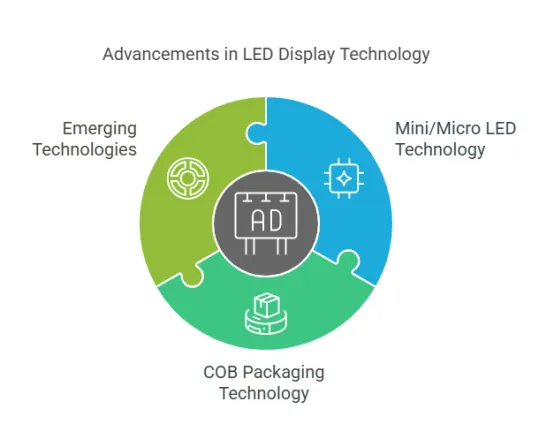

(1) Technological Advancement

Mini/Micro LED Technology

Mini/Micro LED technology features smaller pixel pitch, higher brightness, and lower power consumption, driving LED displays toward thinner, higher resolution, and energy-efficient solutions. The market is expected to reach $3 billion by 2026.

COB Packaging Technology

COB (Chip on Board) packaging improves reliability, and heat dissipation, and reduces costs, driving LED displays toward smaller pitches and higher density. The market for COB technology grew by over 50% in 2022.

Other Emerging Technologies

Quantum dot technology enhances color performance, while flexible display technology enables bendable and foldable screens. The flexible display market is projected to reach $15 billion by 2027.

(2) Application Scenario

Commercial Displays

High-definition, large-sized displays are in high demand in billboards, shopping malls, and hotels, with the market share exceeding 40% in 2022.

Sports Venues

There is strong demand for high-definition, high-brightness, high-refresh-rate LED displays for major events, with the market growing over 20% in 2022.

Stage Rentals

Events like concerts and exhibitions are increasingly demanding creative displays and immersive experiences, with the market growing over 15% in 2022.

Other Application Areas

The demand for LED displays in sectors like transportation, security, and education continues to grow, with the transportation market expected to reach $2 billion by 2027.

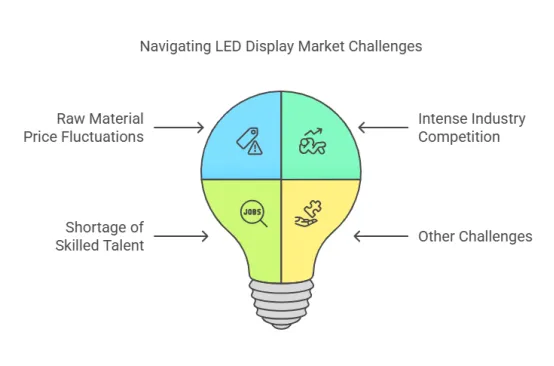

2.3 Market Challenges

(1) Raw Material Price Fluctuations

The prices of key raw materials can fluctuate significantly, affecting the cost and profitability of LED display companies. In 2022, the price of LED chips fluctuated by over 20%.

(2) Intense Industry Competition

The LED display industry is highly competitive, with widespread price wars. In 2022, there were over 1,000 LED display companies in China.

(3) Shortage of Skilled Talent

The rapid pace of technological advancement creates a strong demand for highly skilled technical talent, but supply remains limited. In 2022, the demand for technical talent recruitment increased by over 30%.

(4) Other Challenges

Product homogeneity, inadequate after-sales service systems, and complex international trade conditions are also impacting LED display companies.

Suggestions for Overcoming Challenges

Focus on technological innovation, optimize supply chain management, invest in talent development, enhance brand influence, and expand into overseas markets.

3. Analysis of Foreign LED Display Market

While the global LED display market is thriving, the foreign market presents its unique dynamics. Let’s look at how international players shape the industry and what sets them apart.

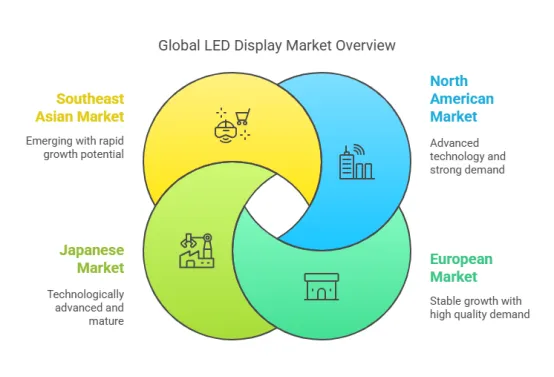

3.1 Key Country and Regional Market Overview

(1) North American Market

One of the largest LED display markets globally, with advanced technology and strong demand.

Key Applications: Commercial displays, sports venues, stage rentals, etc.

Leading Companies: Daktronics, Barco, LG, Samsung, etc.

(2) European Market

A large market with stable growth, where high product quality and performance are essential.

Key Applications: Commercial displays, transportation, security, etc.

Leading Companies: Barco, Lighthouse, Sony, etc.

(3) Japanese Market

Technologically advanced and mature, with high demands for product refinement.

Key Applications: Commercial displays, stage rentals, public displays, etc.

Leading Companies: Panasonic, Sony, NEC, etc.

(4) Southeast Asian Market

An emerging market with rapid growth and significant potential.

Key Applications: Commercial displays, sports venues, stage rentals, etc.

Leading Companies: Chinese LED display companies (such as Leyard, Unilumin, etc.) hold a large share of this market.

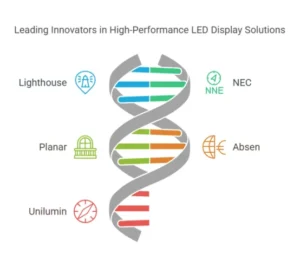

3.2 Well-Known Foreign LED Display Companies

Top 10 International LED Display Companies and Their Key Products as Follows:

(1) Daktronics, USA

Key Products: Vanguard Series (Transparent LED Display), AllSport Series (Sports Venue LED Display), Galaxy Series (Commercial LED Display)

Features: Diverse product range covering sports venues, commercial displays, transportation, etc., known for high reliability and stability.

(2) Barco, Belgium

Key Products: NX Series (Small Pixel Pitch LED Display), E2 Series (Creative LED Display), Ols Series (Outdoor LED Display)

Features: Specializes in high-end visualization solutions, offering products with high brightness, color accuracy, and stability.

(3) LG, South Korea

Key Products: Magnit Series (Small Pixel Pitch LED Display), Transparent OLED Series (Transparent LED Display), UltraStretch Series (Curved LED Display)

Features: Extensive product lineup for indoor and outdoor applications, known for high picture quality and cost-effectiveness.

(4) Samsung, South Korea

Key Products: The Wall Series (Micro LED Display), Smart Signage Series (Commercial LED Display), Outdoor Signage Series (Outdoor LED Display)

Features: Leading technology with products offering high brightness, contrast, and refresh rates.

(5) Sony, Japan

Key Products: Crystal LED Series (Creative LED Display), CLEDIS Series (Small Pixel Pitch LED Display), Bravia Series (Commercial LED Display)

Features: Products known for high color accuracy, stability, and fine details.

(6) Lighthouse, Netherlands

Key Products: Lux Series (Transparent LED Display), Canvas Series (Creative LED Display), Nova Series (Small Pixel Pitch LED Display)

Features: Focuses on high-end LED display solutions, offering products with high brightness, color consistency, and reliability.

(7) NEC, Japan

Key Products: V Series (Small Pixel Pitch LED Display), E Series (Commercial LED Display), S Series (Outdoor LED Display)

Features: Diverse product range for both indoor and outdoor applications, known for stability and cost-effectiveness.

(8) Planar, USA

Key Products: DirectLight Series (Small Pixel Pitch LED Display), Leyard Series (Commercial LED Display), Clarity Matrix Series (Video Wall)

Features: Specializes in large-screen display solutions, offering products with high brightness, contrast, and reliability.

(9) Absen, China

Key Products: A Series (Small Pixel Pitch LED Display), K Series (Outdoor LED Display), C Series (Creative LED Display)

Features: High cost-effectiveness with a significant share in global markets.

(10) Unilumin, China

Key Products: Upanel Series (Small Pixel Pitch LED Display), Ubox Series (Outdoor LED Display), Ushape Series (Creative LED Display)

Features: Extensive product lineup for both indoor and outdoor applications, known for high reliability and cost-effectiveness.

If you want to know more detailed information, you can click this article: https://www.linsnled.com/top-10-led-screen-manufacturers-in-world.html

3.3 Mainstream Products and Competitiveness in Foreign Markets

(1) Small Pixel Pitch LED Displays

Foreign manufacturers are leaders in small pixel pitch LED technology, offering high-performance products, although they come at a higher price point.

Notable Products: Barco NX Series, LG Magnit Series, Samsung The Wall Series.

(2) Transparent LED Displays

Foreign companies were early pioneers in transparent LED technology, with mature technology and a wealth of application cases.

Notable Products: Daktronics Vanguard Series, Lighthouse Lux Series.

(3) Creative LED Displays

Foreign manufacturers excel in creative LED displays, showcasing strong design and technical capabilities, with unique shapes and stunning visual effects.

Notable Products: Barco E2 Series, Sony Crystal LED Series.

4. Analysis of Domestic LED Screen Market

Turning our focus to the domestic market, it’s clear that local players are carving out a strong presence. With a mix of innovation and cost efficiency, they’re not just keeping pace but often setting the tone for the industry. Let’s dive into what makes this market tick.

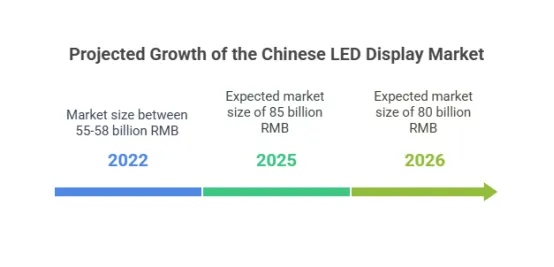

4.1 Domestic Market Size and Growth

(1) Market Size

In 2022, the Chinese LED display market size was between 55-58 billion RMB. It is expected to reach 85 billion RMB by 2025 and 80 billion RMB by 2026, with an annual compound growth rate of approximately 9.8%-10.5%.

(2) Market Growth Rate

The Chinese LED display market has seen stable growth in recent years. Although the pandemic slowed down the growth rate, the market is expected to recover as the pandemic is controlled.

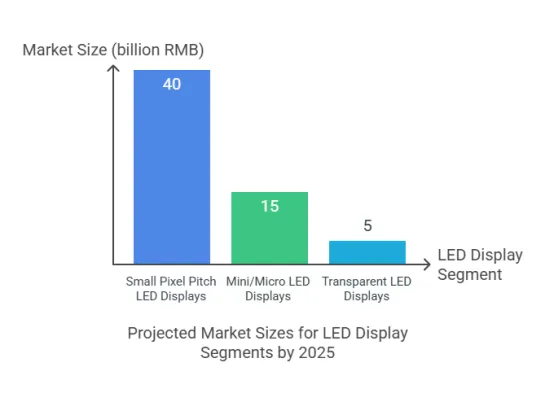

(3) Segment Market Size and Growth Rate

Small Pixel Pitch LED Displays (≤P2.5):

In 2022, the market size was around 25 billion RMB. By 2025, it is expected to reach 40 billion RMB, with a compound annual growth rate of 12.8%.

Main applications: Control rooms, meeting rooms, broadcasting, commercial displays, etc.

Mini/Micro LED Displays:

In 2022, the market size was about 5 billion RMB. It is forecasted to reach 15 billion RMB by 2025, with a compound annual growth rate of 31.6%.

Main applications: High-end commercial displays, consumer electronics, automotive displays, etc.

Transparent LED Displays:

In 2022, the market size was approximately 2 billion RMB. By 2025, it is projected to reach 5 billion RMB, with a compound annual growth rate of 18.9%.

Main applications: Commercial windows, stage rentals, building facades, etc.

References

GGII (Gaogong LED Research Institute): https://www.gg-ii.com/

China Optics and Optoelectronics Manufacturers Association (COEMA): http://www.leds.org.cn/

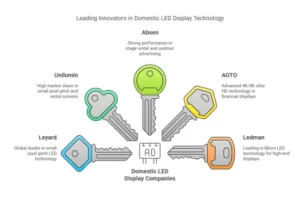

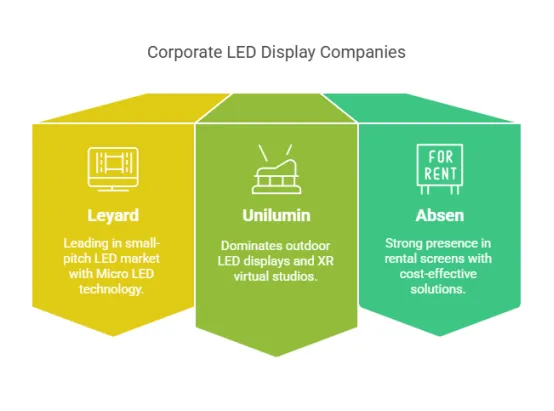

4.2 Domestic Well-known LED Display Companies

(1) Leyard

Representative Products: Small Pixel Pitch LED, Micro LED

Strengths: Global leader in small pixel pitch LED technology, advanced COB packaging, widely used in high-end applications such as command centers and meeting rooms.

(2) Unilumin

Representative Products: Small Pixel Pitch LED, Rental Screens

Strengths: High market share in small pixel pitch LED, excellent performance in stage rental screens and outdoor advertising screens.

(3) Absen

Representative Products: Stage Rental Screens, Outdoor Advertising Screens

Strengths: Strong performance in overseas markets, widely used in large-scale events, exhibitions, and sports venues.

(4) AOTO

Representative Products: Ultra HD LED, Financial Displays

Strengths: Advanced 4K/8K ultra HD LED technology, dominant in the banking, securities, and conference display sectors.

(5) Ledman

Representative Products: COB Packaging Micro LED

Strengths: Leading in Micro LED technology, suitable for high-end meetings, education, and command-and-control displays.

(6) Qiangli Jucai

Representative Products: Outdoor Advertising LED Screens

Strengths: High cost-effectiveness, widely used in outdoor advertising and commercial displays, with a significant market share.

(7) LianTronics

Representative Products: Transparent LED Screens, Advertising LED Screens

Strengths: Dominates the transparent LED screen market, ideal for commercial displays and window advertising.

(8) Shenzhen Gloshine

Representative Products: Stage Rental Screens, Transparent LED Screens

Strengths: High stability in rental screens, extensively used in concerts, exhibitions, and other large-scale events.

(9) Sansi

Representative Products: Smart Traffic LED, Outdoor LED

Strengths: Leading the smart traffic LED display market, products include LED traffic signals and smart streetlight screens.

(10) Mary LED

Representative Products: XR Virtual Shooting LED Screens

Strengths: Advanced XR virtual shooting LED solutions, ideal for film production, live streaming, and related applications.

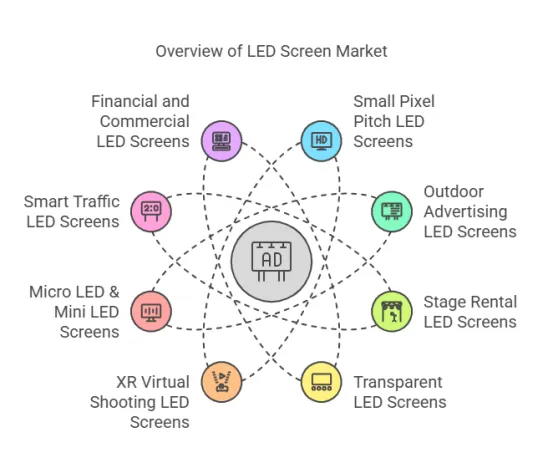

4.3 Mainstream Products and Competitiveness in the Domestic Market

(1) Small Pixel Pitch LED Screens

Small pixel pitch LED screens (P2.5 and below) are mature in technology and widely used in high-end scenarios. Leyard and Unilumin have a high global market share.

(2) Outdoor Advertising LED Screens

Outdoor LED screens with P4-P10 pixel pitch feature high brightness, waterproof, and dustproof technologies, making them suitable for urban advertising and traffic guidance. Qiangli Jucai offers high cost-effectiveness, while Unilumin and Absen are highly competitive.

(3) Stage Rental LED Screens

Rental screens require light weight, high refresh rates, and high gray scale. They are widely used in concerts and exhibitions. Absen and Shenzhen Gloshine see strong demand in Europe and the U.S., while Leyard excels in high-end applications.

(4) Transparent LED Screens

Mainly used in glass curtain walls and commercial windows. LianTronics holds a significant market share, and Unilumin has a technical edge in high-end applications.

(5) XR Virtual Shooting LED Screens

With the growing demand in the film industry, Mary LED and Leyard’s LED screens are widely used in movie production, live streaming, and advertisements. Unilumin offers complete XR solutions.

(6) Micro LED & Mini LED Screens

Micro LED is a high-end display technology. Leyard and Ledman are leaders in market development, primarily applied in high-end meetings and home theaters.

(7) Smart Traffic LED Screens

Used in highways and smart traffic systems, Sansi is the market leader, while Qiangli Jucai is suitable for small to medium-sized projects.

(8) Financial and Commercial LED Screens

Widely used in banks and commercial centers. AOTO excels in the financial sector, while Leyard and Unilumin are strong in the commercial market.

Overall Market Trends

The high-end market is driving growth in small pixel pitch, Micro LED, and COB technologies. Intelligence is enhancing smart city applications. International expansion accelerates global presence, and customized demand is on the rise.

5. LED Screen Application Field Analysis

LED screens are everywhere these days, and their uses keep growing. From bright city billboards to massive sports stadium displays, they’re changing how we share information and create experiences. Let’s break down where they’re making the biggest impact.

5.1 Commercial Display

(1) Market size and growth trend

The global commercial display market is expected to reach tens of billions of dollars by 2025, with growth benefiting from digital advertising, smart retail, and smart city construction, especially the continued rise in demand for LED displays.

(2) Main application scenarios

Outdoor LED billboards, LED screens in shopping malls, and hotel LED screens are used for brand promotion, product display, promotional information, event display, and information release respectively.

(3) Representative manufacturers and products

Leyard: Provides a full range of commercial LED displays, which are widely used in advertising and retail fields.

Absen: Known for its high-brightness and high-definition LED screens, suitable for outdoor advertising and shopping mall displays.

Samsung: Launched a variety of commercial LED displays, focusing on the high-end commercial display market.

5.2 Sports Venues

(1) Market size and growth trend

The market for LED display screens in sports stadiums is growing rapidly, with an average annual growth rate of more than 10% expected in the next few years. The main driving factors include the increasing demand for large-scale sports events and the intelligent upgrade of sports stadiums.

(2) Main application scenarios

LED display screens are mainly used for live broadcasts of games, information release, interactive content display and advertising playback in football fields, basketball courts and stadiums.

(3) Representative manufacturers and products

Unilumin: Provides large-scale LED display screens for sports stadiums, which are widely used in domestic and foreign events.

AOTO: Focuses on display solutions for sports stadiums, and its products are known for their high refresh rate and high stability.

Daktronics: A leading global supplier of LED display screens for sports stadiums, with products covering multiple international events.

5.3 Stage Rental

(1) Market size and growth trend

The stage rental LED display market is growing rapidly, with an average annual growth rate of more than 15%. It is mainly driven by the demand for large-scale events such as concerts, parties and exhibitions, especially the increasingly widespread application of high-definition and flexible LED screens.

(2) Main application scenarios

In concerts, parties and exhibitions, LED screens are used for stage backgrounds, information releases, interactive content displays and product displays.

(3) Representative manufacturers and products

Leyard: Provides high-definition and highly flexible rental LED screens, which are widely used in large-scale events.

Absen: Known for its lightweight and easy-to-install rental LED screens, suitable for various stage activities.

Barco: Provides high-end rental LED screens, focusing on large-scale concerts and international exhibitions.

5.4 Other Application Areas

The application of LED display screens in the fields of transportation, security and education will be combined with the Internet of Things, AI technology and interactive teaching to promote intelligent development.

6. Market Share and Competition Pattern

The LED display industry is a competitive arena where big players and newcomers are constantly vying for dominance. From global brands to regional leaders, the battle for market share is fierce, with each company bringing its own strengths to the table. Let’s take a closer look at who’s ahead and how the competition is shaping up.

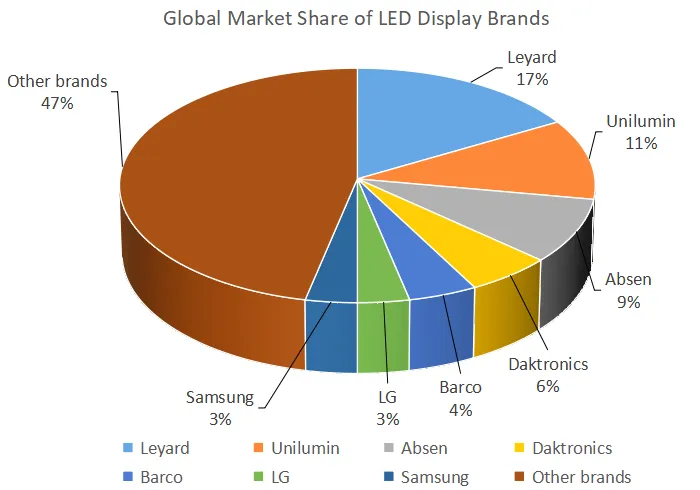

6.1 Global Market Share Distribution (By Brand)

(1) Overview of global market share

Chinese LED display screen companies dominate the global market, with a market share of more than 70%.

Well-known foreign brands such as Daktronics, Barco, LG, Samsung, etc. mainly occupy the high-end market, with a relatively small market share.

(2) Market share of major brands (estimated)

Leyard: Global market share of about 15%, China market share of about 20%, main products are small-pitch LED display screens, transparent LED display screens, etc.

Unilumin: Global market share of about 10%, China market share of about 15%, main products are small-pitch LED display screens, outdoor LED display screens, etc.

Absen: Global market share of about 8%, China market share of about 12%, main products are small-pitch LED display screens, rental LED display screens, etc.

Daktronics: Global market share is about 5%, and its main products are sports stadium LED screens, commercial display LED screens, etc.

Barco: Global market share is about 4%, and its main products are high-end visualization solutions, including small-pitch LED screens, creative LED screens, etc.

LG: Global market share is about 3%, and its main products are commercial display LED screens, transparent LED screens, etc.

Samsung: Global market share is about 3%, and its main products are Micro LED screens, commercial display LED screens, etc.

Other brands: Global market share is about 42%, including many Chinese and foreign brands.

References

TrendForce: https://www.trendforce.com/

Omdia: https://www.omdia.com/

GGII: https://www.gg-ii.com/

LED Display Application Branch of China Optics and Optoelectronics Industry Association: http://www.leds.org.cn/

Chinese LED display companies dominate the global market, but need to move towards the high-end market through technological innovation and enhancing brand influence.

6.2 Competitiveness of Chinese Enterprises in the Global Market

(1) Core Competitive Advantages

Chinese LED display companies dominate the global mid- and low-end markets with their market share, complete industrial chain, technological innovation and cost-effectiveness.

(2) Challenges

Chinese brands lack brand power and technological autonomy in the high-end market and face pressure from supply chain risks and international trade barriers.

(3) Future Competitiveness Enhancement Path

Improve competitiveness through technological breakthroughs, brand internationalization, vertical integration and ecological cooperation, and expansion of emerging application scenarios.

(4) Typical Corporate Cases

Leyard

Advantages: No. 1 in global small-pitch LED market share and leading Micro LED technology.

Layout: Cooperate with Hollywood film and television companies to enter the virtual shooting market; launch 0.4mm pitch Micro LED products.

Unilumin

Advantages: No. 1 in global market share of outdoor LED display screens and layout of XR virtual studios.

Breakthrough: Provide LED stadium fence screens for the Qatar World Cup to enhance international brand image.

Absen

Advantages: Leading in the rental screen market and high cost-effective products.

Strategy: Covering more than 100 countries through overseas agent network, with outstanding local service capabilities.

7. Linsn LED- Best Choice for You

When selecting an LED screen provider, Linsn LED stands out as a top choice for several reasons, including their factory size, exceptional service, and wide range of high-quality products.

7.1 Factory Size and Capability

Linsn LED operates a state-of-the-art factory covering 12,000 square meters, ensuring they have the infrastructure to handle large-scale production. This enables them to efficiently meet both small and large project requirements.

The scale of their facility also supports rigorous quality control processes, ensuring every product meets the highest standards.

7.2 Comprehensive Product Range

Linsn LED offers a wide variety of products, ensuring they can cater to various customer needs. Their product line includes:

UHD Small Pixel LED Displays for high-resolution, detailed visuals.

Rental and Fixed LED Displays for both temporary and permanent installations.

Outdoor and Indoor Options designed for various environments, ensuring brightness and durability.

Creative Displays for unique, customized projects.

Sports Perimeter Screens designed for stadiums.

Advertising Displays to attract attention in commercial spaces.

Frontal Service Displays for easy maintenance and installation.

7.3 Quality and Certifications

Linsn LED’s products come with various industry certifications, such as CE, EMC-B, FCC, RoHS, and IECEE, ensuring their compliance with international quality and safety standards. These certifications give customers confidence in the reliability and performance of the products.

7.4 Outstanding Customer Service

Linsn LED provides comprehensive technical support, including a 3-year warranty and 5% spare parts with each product. Their professional team is always available to assist with installation, maintenance, and troubleshooting, ensuring a smooth experience for customers.

This commitment to customer satisfaction makes them a trusted partner for businesses around the world.

7.5 Global Reach and Expertise

With 15 years of industry experience and a strong presence in overseas markets, including Europe, America, South Korea, and Thailand, Linsn LED has a proven track record of successful projects. Their products are used in a variety of settings, including commercial plazas, stadiums, shopping malls, airports, and public spaces.

In conclusion, Linsn LED is a reliable and comprehensive solution for anyone seeking high-quality LED display products. Their large factory, diverse product range, and top-notch customer service make them the best choice for your LED screen needs.

8. Conclusion

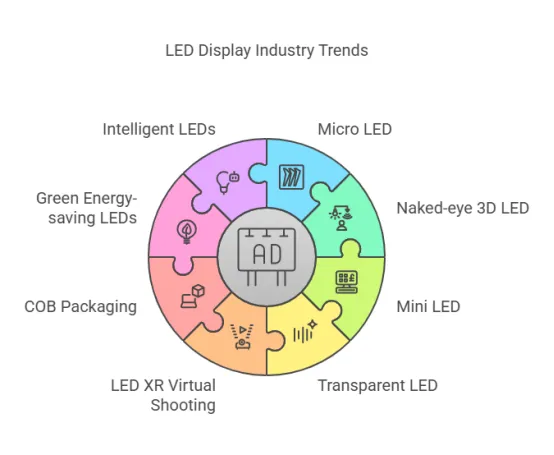

The LED display industry is driving the continuous growth of market demand through breakthroughs in high-end display technology, expansion of new application scenarios, and evolution towards intelligence and energy saving. The following are the main development trends of the industry:

(1) Micro LED

With advantages such as high brightness and low power consumption, it is the mainstream direction of high-end display in the future. It has been applied in commercial display and automotive fields, and will be expanded to consumer electronics in the future. Manufacturers such as Leyard and Samsung are accelerating commercialization.

(2) Naked-eye 3D LED

Providing immersive visual experience, it is widely used in outdoor advertising and cultural tourism scenes. Companies such as Unilumin Technology have implemented many landmark projects.

(3) Mini LED

A cost-effective choice, used in TVs, e-sports monitors and other fields. Manufacturers such as Leman Optoelectronics and TCL continue to invest.

(4) Transparent LED

High light transmittance, suitable for building curtain walls and commercial displays. Companies such as Leyard have launched a number of products, and market demand is growing.

(5) LED XR virtual shooting

Replaces traditional green screens and improves filming efficiency. Manufacturers such as Unilumin Technology have launched professional solutions, which have been adopted by companies such as Disney.

(6) COB packaging

Promote the development of small-pitch LEDs, which are used in high-end conference rooms and 8K displays. Companies such as Leman Optoelectronics continue to make technological breakthroughs.

(7) Green energy-saving LEDs

Using low-power technology and environmentally friendly materials, companies such as Unilumin Technology have launched energy-saving products that meet global environmental standards.

(8) Intelligent LEDs

Combining AI and 5G technologies to achieve remote control and intelligent adjustment, companies such as Unilumin Technology have launched intelligent display systems for use in smart cities and smart retail.

The LED display industry is developing towards high-end, intelligent, and environmentally friendly development. Chinese companies continue to consolidate their leading position in the global market with their technological innovation and scale advantages.

9. Appendix

References

1. TrendForce. (2023). 2023 Global Mini/Micro LED Display Technology Trend Analysis. Retrieved from https://www.trendforce.com

2. Omdia. (2023). Global Display Technology Market Report and Data Analysis. Retrieved from https://www.omdia.com

3. GGII (GGII LED Research Institute). (2023). 2022 China Mini/Micro LED Display Market Research Report. Retrieved from http://www.gg-ii.com

4. IDC (International Data Corporation). (2023). Global and China Display Technology Market Research Report. Retrieved from https://www.idc.com

5. Frost & Sullivan. (2023). Global Display Technology Market Growth Trend and Forecast Analysis. Retrieved from https://www.frost.com

6. China Government Network. Opinions on the Action Plan for the Development of Ultra-High Definition Video Industry. Gazette of the State Council of the People’s Republic of China, 2019-02-28. [Online]. Available: https://www.gov.cn/gongbao/content/2019/content_5419224.htm

Need Expert Advice?

Need Expert Advice?

Choosing the right LED display can feel overwhelming — but you don’t have to do it alone. Our team at Lumivue is here to guide you with personalized recommendations, local support, and reliable solutions that fit your project.